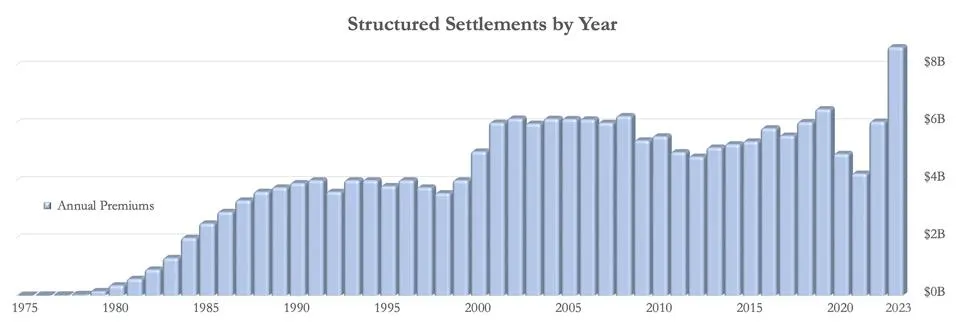

Recent Structured Settlement History

It has not come as a surprise to those involved in the

industry that 2023 would show yet another increase in structured settlement

premiums. Due to increased awareness and a return to normalcy from COVID’s

court closure, 2023 would see premiums of $8.6 billion, quite a large increase

from the $6.0 billion in 2022 and the $5.6 billion average over the past two

decades.

According to National Structured Settlements Trade Association,

structured settlement premiums have more than doubled in the last two years. Many

believe recent interest rate hikes are the main driving force. Mitchel Ashley,

former NYSTLA Board Member, says “The use of structured settlements has a lot

to do with interest rates. When interest rates go high, like now, a structured

settlement is a guaranteed cash flow with no thinking component to it.”

High Interest Rates

I do not think you will find anyone that will argue that structured

settlements do not influence interest rates. At the time of the settlement, the

prevailing interest rates directly influence the growth rate of the underlying

annuity. In other words, the higher the interest rate the larger the payments

the recipient can expect and the lower the interest rate the smaller the

payments the recipient can expect.

Positive Industry Factors

What you must keep in mind is that structured settlements payments

are predictable, guaranteed, tax-free, and, some adjust to inflation. So, you can

see why the industry with this investment instrument has doubled in size in

recent years. But, there are more reasons.

According to the National Structured Settlement Trade

Association and the American Association of Settlement Consultants, the quality

and quantity of available structured settlement education has continued to

improve since virtual conferences were the only option during COVID. Several new

products have entered the market including both funding and technology products.